Three Shades Of Green You Don't Want To Be Tarnished With

Mansfield Advisory Pty Ltd

200 followers

May 17, 2024

Greenwashing, greenhushing, and greenwishing are deceptive sustainability practices that hinder real progress. While these tactics might seem like shortcuts, they ultimately damage a company's reputation, mislead consumers, and harm the environment. But navigating these 'shades of green' is possible! Embracing genuine environmental responsibility attracts talent, boosts brand reputation, and drives positive change. Let's explore how to achieve this!

Greenwashing: The Deceptive Green Facade

Greenwashing involves making misleading claims about a company's environmental and sustainability practices. This can include exaggerating claims of environmental, social or ethical benefit, downplaying negative impacts, or using misleading imagery. As regulatory red lights flash on greenwashing, the crackdown intensifies, exposing companies and their directors to serious legal consequences under the Corporations Act, ASIC Act, and Australian Consumer Law.

Greenwashing can be both intentional and unintentional. Many organisations lack awareness of how their marketing and communication can mislead shareholders and stakeholders. This can happen when they rely on ambiguous statements, exaggerated claims, or vague sustainability buzzwords without truly understanding their meaning. We see this in the overuse of terms like "climate-friendly," "eco-friendly," and "environmentally friendly," often used for assets, products or services with limited environmental benefits.

The High Cost of Greenwashing:

- According to a recent report by Willis Towers Watson, 'Directors and Officers (D&O) Insurance Woes': Greenwashing claims have led to a surge in lawsuits and rising insurance premiums for executives. They project D&O insurance premiums to rise by as much as 20% in 2024, partly driven by this issue. According to ASIC, future cases may move beyond misleading and deceptive conduct to licence obligations, D&O duties, and various other obligations. Future areas of interest are likely to include: Net zero statements and targets; Use of terms such as ‘carbon neutral’, ‘clean’ or ‘green’;and, the scope and application of investment exclusions and screens.

- Reputational Damage: Consumers are increasingly savvy and punish false claims with boycotts and lost sales. A McKinsey study revealed that 79% would ditch a brand caught greenwashing.

- Crackdown on Greenwashing: Governments are getting serious about greenwashing, cracking down with hefty fines and potential restrictions on misleading claims. A recent ACCC internet sweep found a staggering 57% of businesses reviewed made misleading claims about their environmental credentials. The focus isn't just on consumer products anymore. ASIC is taking action too, with ongoing legal battles against superannuation giants like Mercer, Active Super and Vanguard). These cases involve accusations of misleading investors about "sustainable" investments, stopping investments in Russia (when they didn't), and cherry-picking ESG criteria for investment funds. Just recently, the Federal Court found Vanguard's "Ethically Conscious" bond fund guilty of greenwashing for investing in fossil fuels, despite promises to the contrary. The judgement imposed a penalty on Vanguard of A$12.9 Million for its misleading conduct in misrepresenting the “ethical” characteristics of the Fund. Approximately 74% of the securities in the Fund by market value were not researched or screened against applicable ESG criteria. Similarly, Active Super has also now been found guilty of misleading and deceptive conduct in relation to exclusions applied to gambling, coal mining, Russian entities, and oil tar sand investments on its website, reports, and disclosure documents. {Update] The Federal Court on 18th March 2025 imposed a penalty of $10.5 million against Active Super for greenwashing misconduct. This sends a clear message: misleading sustainability claims won't be tolerated by regulators.

- Trademark Infringements: Potential trademark breaches have occurred for referencing Green Star, NABERS, Climate Active, etc., without proper rights or to create misleading impressions. Misusing these trademarks can create a false or misleading impression about a company's sustainability achievements and infringe on the intellectual property rights of these certification schemes.

- Certification Scheme Issues: Climate Active has also faced scrutiny. The Australia Institute filed a complaint in February 2023, alleging the scheme might be misleading. Specifically, the complaint criticizes Climate Active's emphasis on emission offsets for achieving carbon neutrality and awarding certification to fossil fuel companies that offset a small portion of their emissions. The ACCC has not yet resolved this complaint. This raises questions about the eligibility criteria for certification, particularly for sectors like fossil fuels that are required to use safeguard credits. There is also a separate scheme issue raised in a Senante reference committee, questioning whether Climate Active misled participants by not having an approved certified trade mark of their Standard.

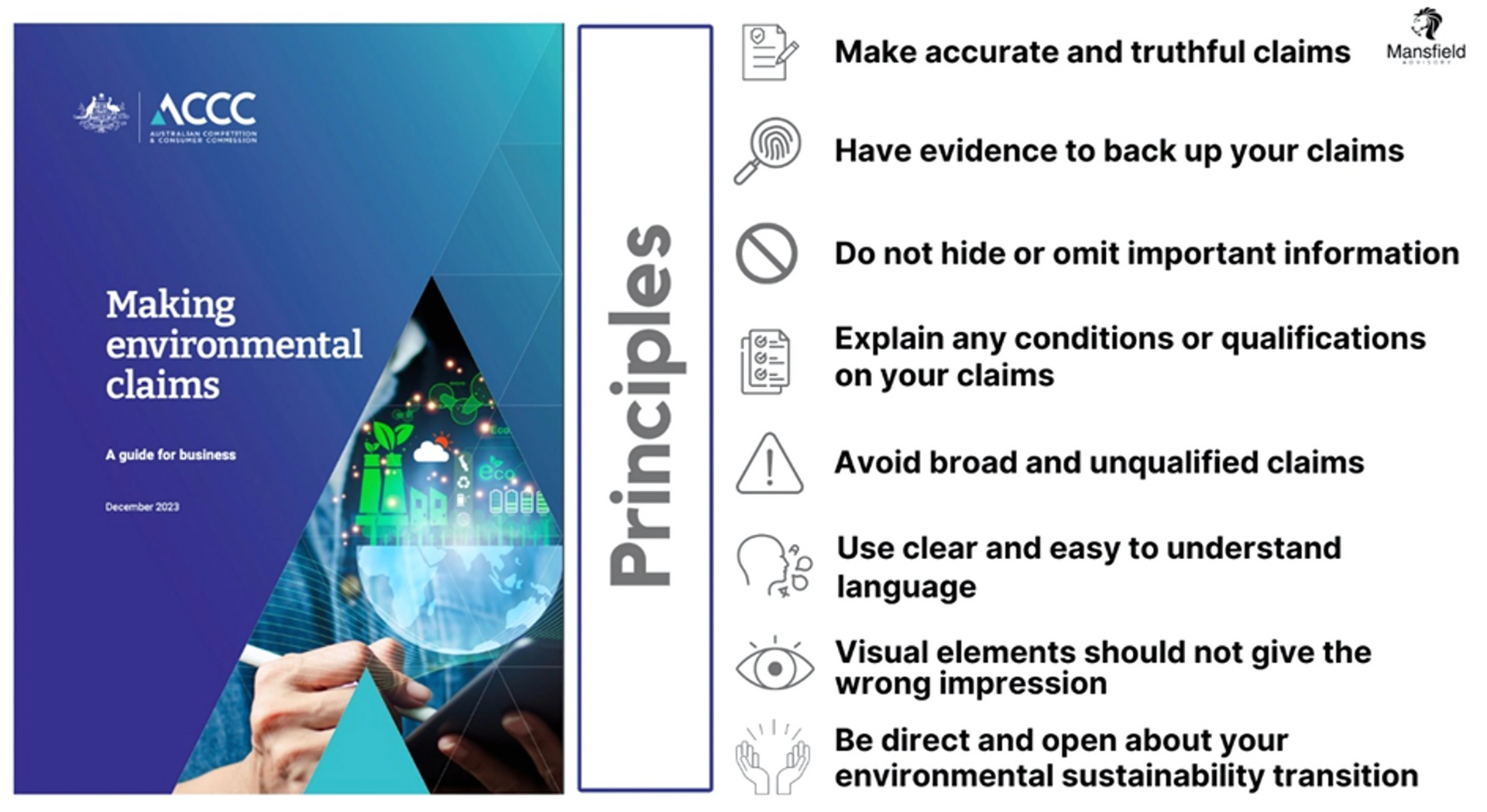

Eight Key Principles To Making Environmental Claims

8 Key Principles extracted from the ACCC's Making Environmental Claims: A guide for business (Dec 2023)

Greenhushing: Silence Speaks Volumes

Stricter greenwashing regulations could trigger greenhushing, where companies shy away from disclosure, fearing non-compliance. This curbs aspirations (showcasing ambitious goals) and risks obscuring negative environmental impacts (unsustainable practices).

The Dangers of Silence:

- Undisclosed Risks: Hidden environmental issues put communities at risk, leading to potential lawsuits and health problems.

- Missed Opportunities: Ignoring sustainability hinders innovation and cost-saving efficiencies. Think of wasted resources and missed chances to improve efficiency.

- Erosion of Trust: Companies that hush environmental or social concerns risk losing public trust, hindering crucial collaboration on environmental challenges. This leaves everyone worse off, as tackling environmental and/or social challenges requires.

With the upcoming introduction of mandatory climate-related financial disclosures, it will be crucial to understand how organisations can leverage transparency as a strategic advantage and as a tool to mitigate risks against greenhushing claims.

Greenwishing: Chasing a Mirage

Companies engage in greenwishing by setting unrealistic or unattainable sustainability goals without a clear plan or substantive actions to achieve them. This often involves making grand pronouncements, such as promising to become carbon neutral by a certain date, without concrete plans, substantiating evidence or resources to back them up. Greenwishing can also be a slippery slope of aspiring to do something without a genuine action plan, ultimately leading to disappointment and hindered progress.

The Mirage's Delusions:

- Misallocation of resources: Companies waste resources chasing impossible dreams instead of focusing on achievable efforts with genuine impact.

- Discouragement and apathy: When ambitious but unrealistic goals are repeatedly missed, stakeholders become disheartened, discouraging further investment in more achievable sustainability efforts.

- Hinders real action: Greenwishing creates a false sense of accomplishment, diverting attention from actual problems and delaying meaningful action.

Being ambitious is not greenwishing: Ambitious sustainability planning emphasises a proactive approach while acknowledging the potential challenges of achieving ambitious goals. The intent and commitment to actions set it apart from wishing that implies inaction.

Beyond the Shades: Embracing Authentic Sustainability

Fortunately, companies can navigate these pitfalls and embrace a genuine path towards sustainability:

- Transparent Storytelling: Focus on verifiable data and real progress, demonstrating your commitment through concrete efforts. Be honest and transparent, and share your genuine sustainability journey. Ensure evidence is easily accessible, clear, based on fact, and readily available.

- Robust Governance: Implement strong internal controls and oversight to prevent deception and ensure compliance. Let accountability be your guiding star.

- Stakeholder Engagement: Listen actively to concerns and address them with transparency. Collaborate with stakeholders and involve them in your sustainability journey.

- Action Speaks Louder than Words: Move beyond lip service and commit to concrete actions that demonstrably improve your environmental impact. Remember, it's about real change, not misleading portrayals of sustainability.

An Australian Sustainable Finance Taxonomy

Mark your calendars! An exciting industry-government initiative is currently developing an Australian sustainable finance taxonomy. Led by the Australian Sustainable Finance Institute (ASFI) through their Taxonomy Project, this initiative aims to leverage international best practices to create a credible, usable, and internationally compatible Australian taxonomy.

This taxonomy will provide clear and consistent definitions of sustainable activities, helping to mitigate greenwashing in investment products and portfolios. The first round of public consultation kicks off on May 28th, and ASFI is seeking feedback on key areas like environmental objectives and criteria for priority sectors like electricity, generation and storage, mining, and the built environment.

Substantiating Sustainability Claims: ISO 14021

Vague sustainability claims can be frustrating for consumers. Voluntary standard ISO 14021 combats this by promoting clear and verifiable environmental assertions. It prohibits use of general terms like "eco-friendly" and emphasises specific, substantiated claims backed by evidence. Think scientific data, not marketing fluff! To enhance credibility, ISO 14021 recommends third-party verification, which is also recommended in ACCC guidance. This can involve Type 1 eco-label certifications like Good Environmental Choice (GECA) and Global GreenTag in Australia. By following ISO 14021 and achieving relevant certifications, companies can demonstrate transparency and provide verifiable evidence of their environmental efforts.

Shine a Light on Genuine Sustainability

Is your company at risk of greenwashing? Navigating the complexities of sustainability can be challenging, but staying true to authenticity is key. Businesses can build a sustainable future by avoiding misleading shades of green and embracing real, positive change.

As the ACCC acknowledges, sometimes businesses do accidentally mislead consumers. By following the ACCC’s guidance and key principles, businesses can make environmental or sustainability claims less likely to mislead consumers and break the law. It’s now up to you to avoid the three shades of green.

The fourth shade: Greengushing

Read the follow-up article on Greengushing here. This is the fourth shade of green you don't want to be tarnished with. Where do we draw the line between genuine environmental impact and exaggerated claims? Read on to unpack the dilemma.

Additional tips:

- Refer to ACCC's greenwashing guidelines and case studies.

- Understand trademark restrictions before referencing Green Star, NABERS, Climate Active, etc

- Prioritise genuine sustainability strategies and communicate them effectively.

Disclaimer: The information contained in the article is intended only to provide a general overview of matters of interest and is intended to apply only within Australia. It does not constitute legal advice.

#Greenwashing #Greenwishing #Greenhusing #SustainableFinance #SustainableConstruction #RiskManagement #Governance #Greenwash #Business #Sustainability

First published on LinkedIn 17th May 2024